The Ultimate Guide To How To Buy Timeshare

Many people are shocked by these costs as they happen, though they need to have understood of their existence from the start. As such, the timeshare principle is surrounded by incertitude, information which is only half-correct and creates extra expenditures and in some cases it is regrettably associated to real scams sellers who want to obtain benefits on our own expenditures.

The seller from whom you purchased your timeshare needs to provide you with a basic kind that you can use. You do deserve to withdraw from the agreement within a particular cancellation duration after you signed the contract. Inspect your state's law for more information about it, or contact the local customer protection office, however be quick, as the cancellation period expires quicker or later.

When you buy a timeshare, the most significant threat is not whether you can cancel your agreement, but that you will never ever be able to recuperate your cash. Liberty from your timeshare concerns is just a telephone call or a click away. Schedule a complimentary assessment with among our Professional Advisors.

Some timeshare buyers understand practically quickly that they've made an error. Other owners battle for several years with loan payments and ever-escalating yearly charges prior to they're all set to surrender. Even the happiest timeshare owners might choose they want out of their agreements, perhaps when they are no longer able to travel.

How To Get Out Of Westgate Timeshare Things To Know Before You Get This

After that, for the majority of owners there's no simple way to get rid of a timeshare. That outrages Jeff Weir, primary correspondent for RedWeek, a timeshare rental and resale website." The industry has actually stopped working to offer a dignified exit for owners," Dam states. "That leaves an opening for crooks and shysters to take benefit (timeshare how does it work)." A common fraud is to promise to offer an owner's timeshare, frequently for an unrealistically high cost, in exchange for an upfront cost, states Brian Rogers, owner of Timeshare Users Group, another online forum for timeshare users.

In reality, few charities are prepared to take timeshares. Timeshare owners need to be wary and practical. Much more individuals desire to offer timeshares than want to buy them. Timeshares at higher-end residential or commercial properties those owned by Disney, Marriott, Wyndham or Hilton, for instance cost at a lot of 15% of their original cost, Dam says.

Maintenance costs average about $900 annually, however can exceed $3,000 for better resorts. A caveat: If you obtained cash from the timeshare designer, that loan has to be paid off before you can sell or distribute your timeshare. Numerous amateur buyers get talked into 10-year loans with rates of interest of 15% or more, Weir says.

Really be familiar with your cash and find cash you can put aside and grow. Wyndham and Diamond Resorts are amongst the few designers with official programs for owners who wish to relinquish their shares, Weir states. The programs are discretionary, implying the chains decide which timeshares they want to reclaim, he says.

The Ultimate Guide To What Is A Timeshare Presentation

Developers that accept returns might require owners to pay annual costs for a year or two while the resort finds another buyer, he states. Beware of people who contact you using to sell your timeshare, because those are typically frauds. If you need help and you own a timeshare at one of the high-end resorts, you can search for a broker through the Certified Timeshare Resale Brokers Association site.

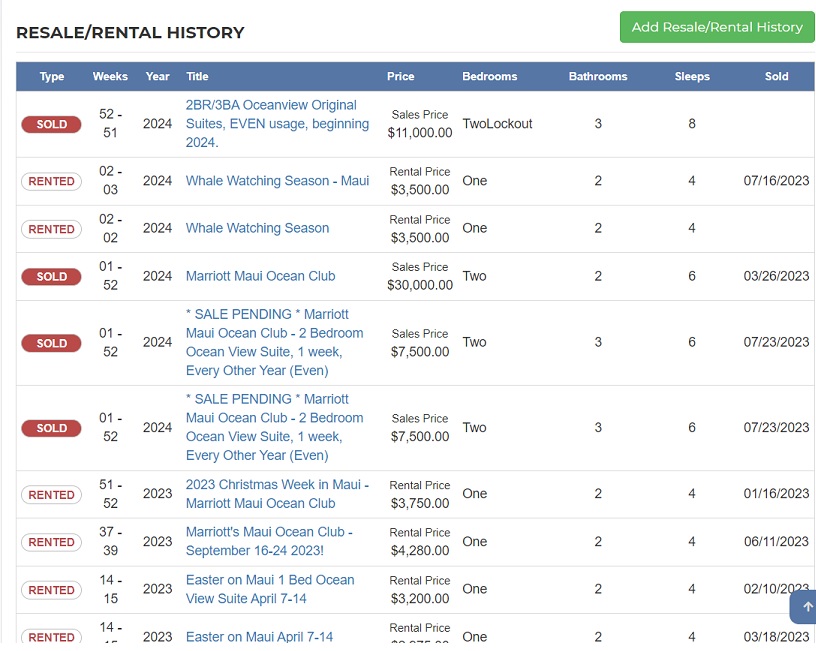

The Timeshare Users Group and RedWeek both have active markets to facilitate sales. RedWeek also has a "What's My Timeshare Worth?" tool to help individuals research study worths based on previous sales through the website, while the Timeshare Users Group has a "bargain bin" section for owners ready to distribute their shares.

Lots of owners find they can lease their timeshares for sufficient to pay or at least considerably offset annual fees, Rogers says. The exact same sites that list timeshares for sale likewise list alternatives to lease. Individuals who stop paying their loans or yearly fees can be based on foreclosure. At a minimum, they ought to anticipate their credit rating to plunge if the developers turn their accounts over to debt collection agency.

The owners "will likely take a credit hit, however the majority of folks do not care at that age." A insolvency filing can suspend collection activity and ultimately eliminate timeshare financial obligation, however that clearly isn't a good option for everyone. Anyone thinking about leaving a timeshare must discuss their circumstance with a skilled personal bankruptcy lawyer who can evaluate the circumstance and discuss alternatives.

3 Easy Facts About How To Get Out Of Timeshare Legally Described

Timeshare rates can differ significantly based upon share size, place and season, not to point out all the variables that impact any other real-estate worth, such as condition of the residential or commercial property and the marketplace for timeshares at the time. A brand-new (or retail) timeshare typically offers in the area of $10,000, although that can differ by thousands of dollars in either instructions.

The preliminary purchase cost is not the only expense to think about, however. All timeshare resorts charge share owners annual fees for upkeep, energies and taxes (how much is timeshare cost). Yearly costs in the $300 to $400 range are typical, although bigger shares or peak-season shares can have greater annual costs, often more than $1,000 every year.

Resorts can increase the charges each year-- the preliminary charges at the time you buy are not locked in. Nevertheless, some timeshare agreements consist of a particular provision that limits future charge increases. In some cases, the yearly fee does not cover residential or commercial property taxes, so share owners would then be accountable for those costs, also.

If the resort chooses to make a significant improvement to the property, or it needs to make major repair work, it may be able to examine a big cost to the shareowners to cover the costs. Examine the terms of your timeshare contract carefully to see if the resort could strike you with a big, unexpected assessment charge in the future.

Unknown Facts About How To Give Away A Timeshare

Owning a timeshare is worthless if you can't manage to get to it. Flying to Mexico or Florida or Colorado every year might grow very pricey. http://rafaelbpjh998.yousher.com/our-how-do-i-sell-my-timeshare-pdfs Next, we'll learn how to get the most out of a timeshare.

You have actually most likely become aware of timeshare properties. In reality, you have actually probably heard something negative about them. However is owning a timeshare actually something to prevent? That's tough to say up until you understand what one really is. This post will examine the basic principle of owning a timeshare, how your ownership may be structured, and the advantages and drawbacks of owning one.

Each buyer generally purchases a particular amount of time in a particular unit. Timeshares typically divide the residential or commercial property into one- to two-week durations. If a buyer desires a longer period, acquiring several successive timeshares may be an option (if available). Conventional timeshare residential or commercial properties normally sell a set week (or weeks) in a home.